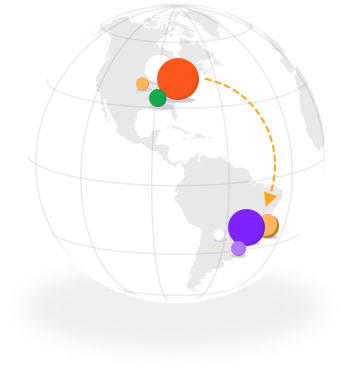

1

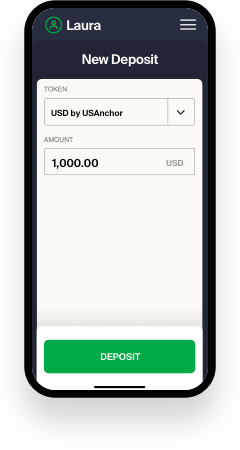

Laura funds her account

Laura starts her deposit

- Laura's wallet crawls USAnchor's stellar.toml to find and display info about their asset.

- Laura opens her wallet and selects the option to deposit USD.

The wallet pings USAnchor's /info endpoint to find and display up-to-date fee info.

The wallet pings USAnchor's /info endpoint to find and display up-to-date fee info.

The wallet pings USAnchor’s WEB_AUTH_ENDPOINT, goes through challenge/response, receives a JWT token to authenticate the user session.

The wallet pings USAnchor’s WEB_AUTH_ENDPOINT, goes through challenge/response, receives a JWT token to authenticate the user session.

The wallet makes a request to USAnchor's /transactions/deposit/interactive endpoint to initiate the deposit.

The wallet makes a request to USAnchor's /transactions/deposit/interactive endpoint to initiate the deposit.

USAnchor's /transactions/deposit/interactive responds with the URL for a webapp Laura will use to complete her deposit.

USAnchor's /transactions/deposit/interactive responds with the URL for a webapp Laura will use to complete her deposit.- The wallet serves USAnchor's webapp in an iframe

Laura's KYC verification

- Using the anchor webapp, Laura enters any info USAnchor requires before accepting a deposit, including KYC. If Laura made a previous deposit, USAnchor should already have KYC info on hand.

- USAnchor analyzes Laura’s KYC info — how they do that is up to them.

Laura deposits USD and receives USD tokens

- When Laura passes USAnchor’s KYC check, the webapp walks her through the rest of the deposit.

- In this case, it directly connects to Laura's bank to initiate the deposit, though some anchors simply display information users need to complete a deposit manually, like a bank account number.

- Laura's funds transfer to USAnchor's account via ACH.

- That transfer happens on a traditional banking system, so it can take a few days.

USAnchor detects Laura’s deposit as it arrives and transfers USD tokens to her wallet’s Stellar account.

USAnchor detects Laura’s deposit as it arrives and transfers USD tokens to her wallet’s Stellar account.- That transfer happens on the Stellar network, so it just takes a few seconds.

2

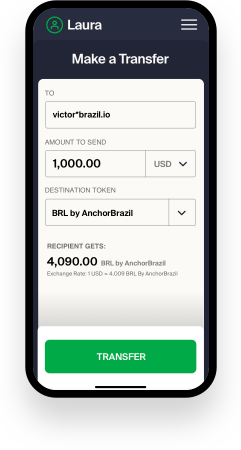

Laura sends money to Victor

Laura makes the payment

- Using her funded wallet, Laura specifies the amount of USD she’d like to send, and the currency Victor would like to receive, BRL.

USD-to-BRL conversion

The wallet executes a pathpayment on the Stellar network, which debits USD from Laura’s account, converts it to BRL using the built-in network orderbooks, and credits Victor with that BRL, all in a single transaction.

The wallet executes a pathpayment on the Stellar network, which debits USD from Laura’s account, converts it to BRL using the built-in network orderbooks, and credits Victor with that BRL, all in a single transaction.

Payment is complete

- Victor gets the BRL in his wallet app a few seconds later.

3

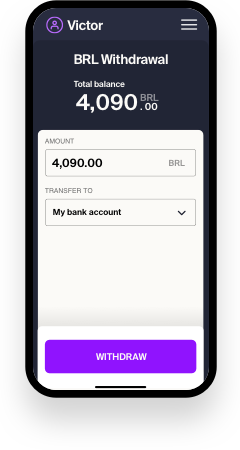

Victor withdraws from his wallet

Victor starts his withdrawal

- Victor's wallet crawls AnchorBrazil's stellar.toml to find and display info about their asset.

- Victor opens his wallet app, pleased to find the payment from Laura, and enters the amount of BRL he’d like to withdraw.

The wallet pings AnchorBrazil's /info endpoint to find and display up-to-date fee info.

The wallet pings AnchorBrazil's /info endpoint to find and display up-to-date fee info.

The wallet pings AnchorBrazil’s WEB_AUTH_ENDPOINT, goes through challenge/response, receives a JWT token to authenticate the user session.

The wallet pings AnchorBrazil’s WEB_AUTH_ENDPOINT, goes through challenge/response, receives a JWT token to authenticate the user session.

The wallet pings AnchorBrazil’s /transactions/withdraw/interactive endpoint to initiate the withdrawal

The wallet pings AnchorBrazil’s /transactions/withdraw/interactive endpoint to initiate the withdrawal

AnchorBrazil's /transactions/withdraw/interactive responds with the URL for a webapp Victor will use to complete his withdrawal, along with an id the wallet uses to keep track of Victor's transaction.

AnchorBrazil's /transactions/withdraw/interactive responds with the URL for a webapp Victor will use to complete his withdrawal, along with an id the wallet uses to keep track of Victor's transaction.- The wallet opens the webapp in an iframe.

Victor's KYC Verification

- Using the anchor webapp, Victor enters his bank account and KYC info.

- AnchorBrazil analyzes Victor’s KYC info — how they do that is up to them.

Victor's withdrawal is completed

To find out if Victor completed his interaction with AnchorBrazil, the wallet polls AnchorBrazil's /transaction endpoint with the id provided in the /transactions/withdraw/interactive above.

To find out if Victor completed his interaction with AnchorBrazil, the wallet polls AnchorBrazil's /transaction endpoint with the id provided in the /transactions/withdraw/interactive above.

When the /transaction endpoint returns pending_user_transfer_start, the wallet displays a confirmation screen summarizing the withdrawal to Victor.

When the /transaction endpoint returns pending_user_transfer_start, the wallet displays a confirmation screen summarizing the withdrawal to Victor.

The wallet sends the specified amount of BRL tokens to AnchorBrazil’s Stellar address.

The wallet sends the specified amount of BRL tokens to AnchorBrazil’s Stellar address.- This transaction happens on the Stellar network, and only takes a few seconds.

- AnchorBrazil transfers an equivalent amount of BRL from their bank account to Victor’s bank account via TED.

- That transfer happens on a traditional banking system, but TED transfers are faster than ACH, and usually complete within a single business day.